IQ Option Review

IQ Option Review

IQ Option is an online trading platform that lets you trade a wide variety of financial instruments, including binary options, stocks, forex, ETFs, commodities, and cryptocurrencies. In this IQ Option review, we will tell you everything you need to know about this broker to help you decide if this company is right for you.

This broker was established in 2013 and is operated by IQ Option LLC With over 48,000,000 registered users and 1,300,000 transactions per day, IQ Option has quickly become one of the most popular trading platforms for traders around the world. IQ Option accepts merchants from over 213 countries, including India, Nigeria, South Africa, the Philippines, Malaysia, Pakistan, and many more.

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

IQ Option Review – Best Broker for Binary Options Trading

IQ Option is known for its user-friendly interface, low minimum deposit requirement, and high leverage ratios. IQ Option also provides its users with a range of educational materials and resources to help them improve their trading skills and stay up-to-date with the latest market trends and news. The platform is regulated by the Cyprus Securities and Exchange Commission (CySEC) and is a member of the Investor Compensation Fund (ICF) which provides protection to traders in case of the company’s insolvency. Overall, IQ Option is a reliable and trustworthy trading platform that caters to both novice and experienced traders.

IQ Option is a trusted broker with verifiable track records and one of the most reputable companies in the industry. Their intuitive trading platform is the best around and we recommend IQ option for traders of all experience levels, which are just starting out.

- Year Founded: 2013

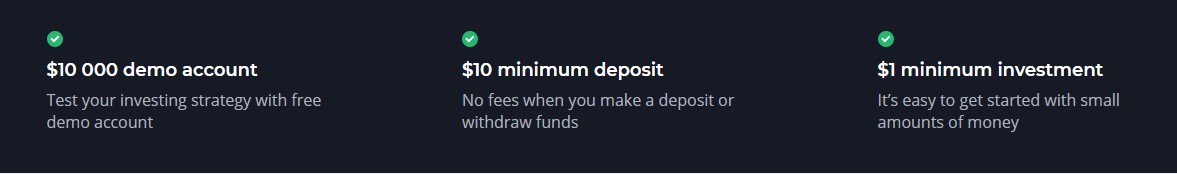

- Minimum Deposit: $10

- Minimum Trade: $1

- Payouts: 100% Max (For a correct prediction)

- Assets: Over 300+ Currency Pairs, Stocks, Crypto, Commodities, ETFs

- Financial Instruments: CFDs, Binary Options, Digital Options

- Trading Platform: iOS, Android, Windows, and MacOS

- Demo Account: Yes

How to Get Started with IQ Option

IQ Option is an online trading platform that allows users to trade various financial instruments including stocks, cryptocurrencies, and forex. If you’re new to trading, getting started with IQ Option can seem overwhelming. Here are some steps to help you get started:

1. Sign up for an account: Visit the IQ Option website and sign up for an account. You’ll need to provide some personal information and verify your account before you can start trading.

2. Practice with a demo account: IQ Option offers a demo account that allows you to practice trading without risking any real money. Use this account to familiarize yourself with the platform and test out different trading strategies.

3. Learn the basics of trading: Before you start trading with real money, it’s important to understand the basics of trading. IQ Option offers educational resources such as video tutorials, webinars, and articles that can help you learn the fundamentals.

4. Choose your trading instrument: IQ Option offers a variety of trading instruments, including stocks, cryptocurrencies, and forex. Choose the instrument that you’re most comfortable with and that fits your trading goals.

5. Set up your trading plan: Before you start trading, it’s important to have a plan in place. Decide how much money you want to invest, what your risk tolerance is, and what your goals are. Then, create a plan that outlines your trading strategy.

6. Start trading: Once you’ve set up your account, practiced with the demo account, and developed a trading plan, it’s time to start trading with real money. Remember to start small and gradually increase your investments as you become more comfortable and confident with your trading strategy.

Overall, getting started with IQ Option requires some effort and patience. By following these steps and taking the time to learn and practice, you can become a successful trader on the platform.

IQ Option Account Types

IQ Option offers four different account types to cater to the needs of traders with varying levels of experience and investment budgets.

1. Demo Account: IQ Option offers a free demo account to all its users, which is an ideal way for beginners to get acquainted with the platform and learn how to trade without risking any real money. The demo account comes with a virtual balance of $10,000, and traders can use it to practice their trading strategies, test out different assets, and get a feel for the platform’s features and functionalities.

2. Standard Account: The standard account is the most popular account type among IQ Option users. It requires a minimum deposit of $10 and comes with a range of features and benefits, including access to all trading assets, 24/7 customer support, and a range of educational resources. Standard account holders can also participate in tournaments and receive daily market analysis reports.

3. VIP Account: The VIP account is designed for more experienced traders who are willing to invest larger sums of money. It requires a minimum deposit of $3,000 and comes with all the features and benefits of the standard account, plus a personal account manager, exclusive access to trading tournaments, faster withdrawals, and higher payouts.

4. Institutional Account: The institutional account is designed for large-scale traders and institutional investors. It requires a minimum deposit of $10,000 and comes with customized trading solutions, dedicated account managers, and access to a range of advanced trading tools and features.

Overall, IQ Option’s account types cater to the needs of traders with varying levels of experience and investment budgets and provide them with access to a range of features and benefits that can help them maximize their trading potential.

Trading Assets

IQ Option is a leading online trading platform that provides traders with access to a wide range of trading assets. These assets include stocks, currencies, indices, commodities, and cryptocurrencies. The platform offers more than 500 different assets to trade, ensuring that traders have plenty of options when it comes to building their trading portfolios.

Stocks: IQ Option offers traders access to a wide range of stocks from some of the world’s leading companies. Traders can trade stocks from companies such as Apple, Amazon, Google, Coca-Cola, and more.

Currencies: The platform allows traders to trade currencies from various countries. These include major currencies such as the US dollar, Euro, British pound, Japanese yen, and Australian dollar, as well as minor currencies such as the Mexican peso, South African Rand, and Turkish lira.

Indices: Traders can also trade indices on IQ Option. These indices represent a basket of stocks that are grouped together to provide a snapshot of the overall performance of a particular market. Examples of indices that traders can trade on the platform include the S&P 500, Dow Jones, Nasdaq, FTSE 100, and Nikkei 225.

Commodities: IQ Option provides traders with access to a range of commodities such as gold, silver, crude oil, natural gas, and platinum. These commodities are traded on the platform in the form of futures contracts.

Cryptocurrencies: The platform also allows traders to trade cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple. These cryptocurrencies are becoming increasingly popular among traders due to their high volatility and potential for significant returns.

Overall, the wide range of trading assets provided by IQ Option offers traders a diverse set of options to choose from when building their trading portfolios. This diversity ensures that traders can find assets that match their trading style, risk tolerance, and investment objectives.

Trading Platforms & Mobile Apps

IQ Option is a popular online trading platform that offers a range of financial products and assets, including forex, stocks, commodities, cryptocurrencies, and more. The platform is known for its user-friendly interface, low minimum deposits, and wide range of trading tools and indicators.

One of the key features of IQ Option is its trading platforms, which are available in both web and mobile versions. The web platform is accessible through any web browser and offers a range of features such as real-time quotes, customizable charts, technical indicators, and more. The mobile app, on the other hand, is available for both iOS and Android devices and allows traders to access their accounts on the go.

The IQ Option trading platforms are designed to be easy to use, even for beginners. Traders can easily navigate the platform, place trades, and manage their accounts. The platform also offers a range of educational resources, including video tutorials, articles, and webinars, to help traders learn more about trading and how to use the platform effectively.

One of the standout features of IQ Option’s trading platforms is the range of trading tools and indicators available. Traders can use tools such as trend lines, Fibonacci retracements, and support and resistance levels to help them make better trading decisions. The platform also offers a range of technical indicators, such as moving averages, MACD, and RSI, which can be used to analyze market trends and identify potential trading opportunities.

In addition to the trading platforms, IQ Option also offers a range of mobile apps for both iOS and Android devices. These apps allow traders to access their accounts and trade on the go, making it easier to stay on top of their investments. The mobile apps also offer a range of features, such as real-time quotes, customizable charts, and technical indicators, to help traders make informed trading decisions.

Overall, the IQ Option trading platforms and mobile apps are well-designed, user-friendly, and offer a range of features and tools to help traders make informed trading decisions. Whether you’re a beginner or an experienced trader, IQ Option has something to offer, making it a popular choice for online trading.

Commission & Fees

As with any financial service, IQ Option charges fees and commissions for its services. Here is a breakdown of the IQ Option commission and fees:

1. Trading Fees: IQ Option charges a commission for each trade executed on its platform. The commission varies depending on the trading instrument and the type of account. For example, forex trading fees start from 0.0018% for standard accounts and 0.0005% for VIP accounts.

2. Overnight Fees: If you hold a position overnight, IQ Option charges an overnight fee. This fee is also known as a swap fee and is charged for the cost of holding the position. The overnight fee varies depending on the trading instrument and the type of account.

3. Deposit & Withdrawal Fees: IQ Option does not charge deposit fees, but there may be fees charged by the payment provider. Withdrawal fees vary depending on the payment method and the type of account. For example, withdrawals via Skrill and Neteller are free for VIP account holders, but standard account holders may be charged a fee.

4. Inactivity Fees: If you do not make any trades or deposits for 90 days, IQ Option charges an inactivity fee of $50 or the total balance of the account, whichever is lower.

5. Currency Conversion Fees: If you deposit funds in a currency different from your account currency, IQ Option charges a currency conversion fee of 2%.

Overall, IQ Option’s commission and fees are competitive with other online trading platforms. However, it is important to understand the fees associated with each transaction before executing a trade.

Deposit & Withdrawal Methods

In order to start trading on IQ Option, users need to deposit funds into their accounts. The platform supports various deposit and withdrawal methods, making it easy for users to manage their funds.

Deposit Methods:

1. Credit/Debit Card: IQ Option accepts Visa, Mastercard, and Maestro cards for depositing funds. The minimum deposit amount is $10 and the maximum is $10,000.

2. E-wallets: IQ Option supports several popular e-wallets such as Skrill, Neteller, WebMoney, and Qiwi Wallet. The minimum deposit amount for e-wallets is $10 and the maximum is $10,000.

3. Bank Transfer: Users can also deposit funds via bank transfer. The minimum deposit amount is $10 and the maximum is $10,000.

4. Cryptocurrencies: IQ Option also allows users to deposit funds using cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The minimum deposit amount for cryptocurrencies is $10 and the maximum is $10,000.

Withdrawal Methods:

1. Credit/Debit Card: Users can withdraw funds to their Visa, Mastercard, or Maestro card. The minimum withdrawal amount is $2 and the maximum is $10,000.

2. E-wallets: Users can withdraw funds to their Skrill, Neteller, WebMoney, or Qiwi Wallet. The minimum withdrawal amount for e-wallets is $2 and the maximum is $10,000.

3. Bank Transfer: Users can also withdraw funds via bank transfer. The minimum withdrawal amount is $2 and the maximum is $10,000.

4. Cryptocurrencies: Users can withdraw funds to their cryptocurrency wallet. The minimum withdrawal amount for cryptocurrencies is $2 and the maximum is $10,000.

Overall, IQ Option offers a variety of deposit and withdrawal methods that cater to the needs of traders from different countries. The platform also ensures the safety and security of user funds by using advanced encryption and security protocols.

Education & Customer Support

IQ Option Education & Customer Support is a comprehensive resource that provides traders with the knowledge and tools they need to succeed in the financial markets. The platform prides itself on its user-friendly interface, which makes it easy for beginners to navigate and learn about trading.

The IQ Option Education Center offers a range of materials, including video tutorials, webinars, articles, and trading strategies. These resources cover a wide range of topics, from basic concepts like support and resistance to more advanced topics like technical analysis and risk management.

In addition to educational resources, IQ Option also provides excellent customer support. Traders can reach out to the support team via email, phone, or live chat, and they can expect a fast and helpful response. The support team is available 24/7, so traders can get assistance whenever they need it.

Overall, IQ Option Education & Customer Support is an excellent resource for traders of all levels. Whether you’re just starting out or you’re an experienced trader, you’ll find plenty of valuable information and support to help you succeed in the financial markets.

IQ Option Pros & Cons

IQ Option is a popular online trading platform that allows users to trade a variety of financial instruments, including stocks, options, forex, and cryptocurrencies. While the platform has gained a reputation for its user-friendly interface and low minimum deposit requirements, it also has its share of strengths and weaknesses. Here are some of the key pros and cons of using the IQ Option:

Pros:

1. User-friendly platform: IQ Option’s platform is intuitive and easy to use, making it a great choice for beginners who are just starting out with online trading.

2. Low minimum deposit: With a minimum deposit of just $10, IQ Option is accessible to traders of all levels, and is a good option for those who want to start trading with a smaller budget.

3. Wide range of assets: IQ Option offers a broad selection of financial instruments, including stocks, options, forex, and cryptocurrencies, allowing traders to diversify their portfolios.

4. Competitive fees: IQ Option’s trading fees are relatively low compared to other platforms, making it an affordable choice for traders who want to keep their costs down.

5. Demo account: IQ Option offers a free demo account, which is a great way for traders to test out the platform and practice their trading strategies before committing real money.

Cons:

1. Limited regulatory oversight: IQ Option is not regulated by any major financial regulatory body, which may be a concern for some traders who prefer to trade on platforms that are more closely monitored.

2. Limited customer support: While IQ Option offers customer support via email and live chat, it can sometimes be difficult to get a quick response, which can be frustrating for traders who need help with a trade.

3. Limited educational resources: While IQ Option does offer some educational resources, including video tutorials and a blog, these resources may not be comprehensive enough for traders who are looking to learn more about trading strategies and techniques.

4. Limited payment options: While IQ Option accepts a range of payment methods, including credit cards, e-wallets, and bank transfers, it does not accept PayPal, which may be a drawback for some traders.

5. Limited trading tools: While IQ Option offers basic trading tools such as charts and technical indicators, it does not offer more advanced trading tools such as algorithmic trading and backtesting, which may be a drawback for more experienced traders.

Is IQ Option a Legitimate Binary Options Broker?

Yes, IQ Option is a legitimate binary options broker. However, it is important to note that many countries have different regulations and laws on the use of online trading platforms. Therefore, it is always advisable to seek legal counsel or conduct thorough research on the specific laws and regulations of a country before engaging in any online trading activities.

IQ Option Review – Conclusion

Through this IQ Option Review, we can conclude that IQ Option is a reliable and user-friendly trading platform that offers a wide range of trading options for both beginners and experienced traders. With a simple and intuitive interface, low minimum deposits, and a range of account types, IQ Option provides a flexible and accessible trading experience. The platform also offers a range of educational resources to help traders improve their skills and make informed investment decisions. Overall, IQ Option is a trustworthy and reputable trading platform that offers a range of benefits for traders of all levels.